Nonprofit Leaders Spotlight |

Dimple Abichandani, Executive Director of the General Service Foundation

November 22, 2019

by George Suttles

Investment Strategy | People

Dimple Abichandani is executive director of the General Service Foundation, a private grant making family foundation that dedicates all its resources to bringing about a more just and sustainable world.

George Suttles: Thanks for taking the time to speak with us today. Before we begin, why don’t you tell us about your foundation.

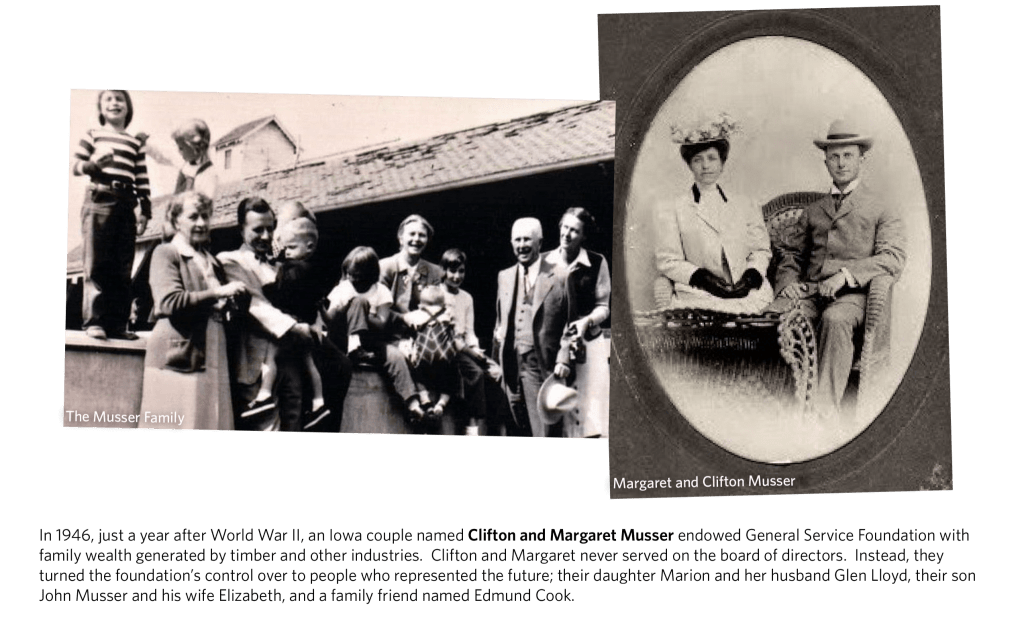

Dimple Abichandani: The General Service Foundation is a social justice funder that supports grassroots organizations advancing racial and gender justice. We were founded 73 years ago and have an endowment of $75 million. I’ve been the Executive Director for four years. The Foundation supports organizations advancing racial and gender justice through work that builds the power of communities most impacted by injustice to win change.

Suttles: If I understand correctly, your foundation is a family foundation. Are there family members on the board currently? What are they interested in from an investment standpoint?

Abichandani: The Board is comprised of twelve members, ten of whom are third and fourth generation members of the family.

Over the last decade, the fourth generation of our board has stepped into leadership. Also, during this time, our board has taken a greater interest in impact investing with a goal of living into our values across all of our efforts at the foundation. We began our impact investing in 2009 with a goal to move 10% of our assets to impact investments. Today we have about 30% of the foundation’s assets in impact investments. Our impact investments have largely been climate related investments, though recently we have also been exploring low income housing and other more justice oriented investments.

What I find exciting is how we are trying to bring our values to our investments, not only on the “impact” side but across the entire portfolio. For the last year and a half, our board has been engaging our investment advisors about how we can advance racial and gender justice through our investments. That has changed the conversation with our investment advisors, and we have changed our investment policy to include a criterion about the racial and gender diversity of the fund’s managers. The challenge, of course, is that the broader financial sector is one that has lacked diversity for so long. But we are excited to be a part of a growing number of foundations that are pushing the sector to be more representative of our society overall.

“What I find exciting is how we are trying to bring our values to our investments, not only on the ‘impact’ side but across the entire portfolio..”

– Dimple Abichandani

Suttles: You have spoken about the board’s philosophy regarding the portfolio; so how do they do their work?

Abichandani: Our foundation’s bylaws create an Investment Committee that is charged with investment decisions. The Investment Committee works closely with our investment advisors and drafts and updates our investment policy. When interest in impact investing emerged on our board, we created an impact investing working group, with the purpose of engaging in deeper learning about impact investing. A few years ago, we merged the impact investing working group with the Investment Committee, and that has allowed for the lessons learned by the working group to infuse our investment decisions more broadly.

Suttles: How does framing the investments as a mechanism to have an impact shift the way the board thinks about its spending policy?

Abichandani: As we have been considering our spending policy, our goal is to align our values with our spending. Investments are another area of foundation effort where we want to integrate our values. In the early days of impact investing, it was considered quite risky. But that isn’t the case anymore. I appreciate how our Board brought curiosity, a desire to learn, and comfort with risk to their early impact investing efforts.

Suttles: And what about the foundation’s spending policy? Does it live with the Investment Committee? Do they own it?

Abichandani: At GSF, our entire Board adopts a spending policy and votes on a budget each year. We have recently made a big shift to our spending policy. In the past, I worked with our CFO to develop a proposed budget based on our spending policy, and then the full board would review it and vote on it. Our spending policy was mostly mathematical: we would calculate the 3-year rolling average value of our endowment, and then allocate 3.75% of that for the grants budget. We would then add on the admin costs, 1.5-1.9%. We would then cross check this spending percentage with a perpetuity chart that was prepared by investment advisors to ensure that the total spending amount keeps us in perpetuity. We also would make sure we met the IRS 5% minimum payout.

At our board meeting, we would share the draft budget and review these steps with the board and answer any questions before the board voted on the budget. Most years our spending policy resulted in a spending rate between 5.4-5.9%. This was a traditional approach to our spending policy that many of our peers use as well. Once we started to question whether our spending policy could align more deeply with our mission, we came up with a different approach.

“How does framing the investments as a mechanism to have an impact shift the way the board thinks about its spending policy?”

— George Suttles

Suttles: What inspired you to change your spending policy?

Abichandani: In 2016, we prepared a budget based on our traditional policy. Our board was going to consider the budget at a board meeting scheduled a week after the 2016 Presidential election. When the election happened, it was clear to me that we would need to provide additional grant support, as our grantees are groups on the front lines of racial and gender justice movements including, immigration, reproductive rights – groups that would be ramping up to fight threats to our inclusive democracy. When our board met that November, they approved a one-time increase in our payout, in addition to the budget that was developed according to our spending policy.

By the spring of 2017, when we began considering the 2018 budget, we realized that our grantees were working in a dramatically altered environment and were now facing more long-term challenges. We knew we needed to step up in terms of funding. And that was when I began to re-examine our spending policy – because the spending policy had no way for me to take this reality into account.

Most of the resources for spending policies are put out by investment/financial advisors, so it makes sense that the focus is mostly on investments. But traditional ways of thinking about foundation spending policies don’t give us a complete, multi-dimensional view that includes non-financial inputs –like an assessment of current needs and opportunities in the socio-political context.

We wanted a more nuanced approach that allows for a greater number of inputs. We were looking for something that we weren’t finding. I was excited to try to come up with a spending policy that was not solely mathematical. My training is as a lawyer, so I started thinking about how, in the legal context, when you have a complex scenario, what courts do is a “balancing test.” A balancing test allows you to fully explore a set of factors and then weigh them. This approach allows for complexity and nuance in decision-making.

We created a spending policy in which we arrive at our spending rate by weighing and balancing seven factors. Three of the factors are similar to ones we considered under our traditional spending policy: investment returns as expressed in the three-year rolling average, operating expenses and perpetuity. And we added in four new factors for consideration: growth goals, meeting the moment, organizational values/mission, and grants and programs. The factors that we consider in the spending policy are not only diversified and expanded, but importantly, they include our mission as well as external factors like the conditions in the world that affect our work.

As we began working with our new balancing test spending policy, we started asking some fundamental questions about our spending rate. We realized that we can meet our perpetuity goal and spend at a rate higher than what we had been doing. Our culture as an organization is one of healthy risk tolerance and yet we noticed that in our spending there was a cautiousness that we had not examined.

Suttles: What about perpetuity? How does this desire to reimagine your spending policy considerations impact conversations around perpetuity?

Abichandani: It was our habit to think of perpetuity as forever, or infinity. Now, as we use our new policy, perpetuity is no longer a “Yes or No” question, but rather perpetuity is one of seven factors we consider and weigh as we make the decision of how much to spend. Importantly, when we move away from perpetuity-yes or no, we move towards a discussion of what perpetuity means to us in this current moment. Our perpetuity charts use the term “infinity” to denote spending scenarios that will allow the foundation to exist into perpetuity. I find it useful to think about perpetuity more concretely, and for family foundations we can do that by thinking about generations. Do we want the foundation to exist until the 7th generation? The 14th?

What I most appreciate about our new approach is that we are putting our spending in the broader context of what is happening around us. Now we ask, what is 2020 in terms of a year of opportunity? What if every foundation had that as a part of their process when considering spending? What if each institution asked itself what is at stake in this year that we are going to be spending? As a foundation, our spending is purposeful – we need to keep that purpose central as we decide how much to spend.

Suttles: When you are grappling with these factors as inputs into your spending policy, what questions do you consider? What are some examples?

Abichandani: One of the factors we consider as part of our spending policy is our administrative costs. When we first used this new approach of examining and weighing seven factors, I was struck by how even this factor that I consider to be straightforward, generated productive questions from our board. The usual habit for administrative costs is to keep them low. But when we began using our new spending policy and began to discuss and weigh the factor of administrative costs, our board began to ask thoughtful questions inspired by our values. Do staff have the capacity to do the work in a sustainable way? If we are increasing the grants budget, should we increase the admin costs as well? Are we offering benefits that are aligned with our values?

This new approach helps us look at some of the things we do out of habit. So much of what funders do in grantmaking and investing is really habit – that is, we do it because we are used to doing it. But just because they are habits doesn’t mean they are best practice. For example, with investing, many of us have a habit of focusing on growth, but do we know what our growth goals are? For most of us, our organization’s mission is not to grow the endowment – we grow our endowment in service of the mission. If we meet the growth goals, what does that mean for our real social impact/justice goals?

Our new approach to spending gives our board an opportunity to ask these deeper questions and with that, engage in deeper and more effective governance. This is certainly harder than plugging numbers into a formula, but by asking these questions and weighing a set of important inputs, we are landing on a spending rate that is informed by better inputs and reflects strong governance on the part of the board.

Suttles: That is really exciting. Give us an example of how that works in practice?

Abichandani: The first year that we introduced this approach we had the board split into pairs and each pair discussed one factor. Then we brought the full board back together and each pair reported back the highlights of their discussion. Together, the board engaged in a conversation to weigh the factors and come to a spending percentage. The CFO and I had prepared a few options for the board to consider. This process was very engaging and dynamic, and the board came away from it excited about a unanimous decision they made to increase our spending. What I appreciate is that this is deep governance – this is an example of the board making a complex and thoughtful strategic decision. Our board feels invested in the spending decision now, and because of their engagement in this process they can speak to the “why” of our spending, and the various factors that they considered. Now when we look at the budget, the numbers that represent our programs, our engagement, these numbers come to life.

Link to article on Commonfund:

https://www.commonfund.org/news-research/article/nonprofit-leaders-spotlight-dimple-abichandani-gsf/